49 of surveyed staff in Malaysia reported that they havent received any bonuses or incentives in the previous year while 51 said that they received at least one form of monetary bonus. 21000 employers are liable to pay bonuses.

The company paid bonus for the year 2014 to its employees.

. Those who got bonuses reported rates ranging from 3 to 6 of their annual salary. This discretion to pay bonus was based on a performance appraisal of each employee conducted by their superior. So Flexi gains a Bonus of RM1820 instead of RM2000 after the deduction of EPF contribution.

In terms of variable bonuses employers in Malaysia have also increased the average bonus payout to 22 months for 2021 compared to 21 months in 2020 with the Life Sciences and Shared Services industries seeing the highest payout of 24 months. 7000 then the bonus will be calculated on the actual amount by using the formula. More than eight in 10 respondents expect a pay raise 81 per cent or a one-time bonus 84 per cent at the end of their employers fiscal year.

If salary is equal to or less than Rs. Dass explains Aligned with the results from our other surveys Malaysian workers have always ranked salary and financial rewards as important factors that would determine their loyalty towards their employers. Bonus is not required for deduction of SOCSO contribution and EIS contribution.

Bonus pay at EY Ernst Young ranges from RM 4750 to RM 4750 annually among employees who report receiving a bonus. RM 6000 RM 2500 RM 8500 EPF Employer Contribution. What are the types of compensation or severance to include for employees in Malaysia.

RM 3000 RM 2500 RM 5500 EPF Employer Contribution. Bonus Salary x 833 100. For the month of September they receive a bonus of RM250 as part of the companys annual performance bonus.

The Company decided to not award bonus to 10 employees including the complainants due to a low performance rating. It is the amount of money that will finally be available to the employee. For the same employee monthly PCB for salary alone will be RM 130 so the tax for bonus is RM 650 - RM 130 RM 520.

Using our last example if an employee earned RM4000 in gross pay their net pay will be the. Public Bank pays an average of RM 10675 in annual employee bonuses. EY Ernst Young pays an average of RM 6758 in annual employee bonuses.

Bonus Payments Law in Malaysia The employer has a right to choose whether or not to give a bonus on a particular year or how much bonus they should give. Jadual PCB 2020 PCB Table 2018. Which employees are entitled to termination benefits payment.

To calculate the contribution for the month of September the monthly wages should be taken as a total of RM6250. Bonus pay at Public Bank ranges from RM 12000 to RM 12000 annually. For example when an employer pays an employee a monthly salary of RM4000 this means the employee has earned RM4000 in gross salary.

According to the Employment Termination and Lay-Off Benefits Regulations 1980 an employee is entitled to termination benefits payment when their contract of service is terminated for any reason. RM 5500x 12 calculation by percentage EPF Employee Contribution. In terms of variable bonuses employers in Malaysia have also increased the average bonus payout to 22 months for 2021 compared to 21 months in 2020 with the Life Sciences and Shared Services.

RM 5500 x 11 refer Third Schedule. Flexi has a salary of RM2000 per month however he gained a 2-months bonus how to calculate bonus Malaysia. RM 8500 x 12 refer Third.

2 months Bonus RM 2000 x 2 RM 4000. Labor market recovery to gain momentum into 2022. PCB EPF SOCSO EIS and Income Tax Calculator 2022.

As per the amendment on the Payment of Bonus Bill passed in 2015 if the gross earning of the employee is below Rs. For example employee A earns RM6000 per month as their basic salary. The bonus will be calculated as follows.

A relevant case to this issue is the All Malayan Estates Staff Union v Revertex Malaysia Sdn Bhd. Gross includes bonuses overtime pay holiday pay etc. In terms of variable bonuses employers in Malaysia have also increased the average bonus payout to 22 months for 2021 compared to 21 months in 2020 with the Life Sciences and Shared Services industries seeing the highest payout of 24 months.

The lowest paid Malaysia are Services Tourism Hospitality professionals at 6900. The highest paid Malaysia are Legal Department professionals at 60000 annually. Calculate monthly tax deduction 2022 for Malaysia Tax Residents.

Alternatively you may change the Calculate For option to Bonus Only this will show the exact amount of statutory contributions for the bonus component only.

Malaysian Bonus Tax Calculations Mypf My

Average Salary In Kuala Lumpur 2022 The Complete Guide

.png)

All About Basic Salary Wage In Malaysia

Government And Defence Average Salaries In Malaysia 2022 The Complete Guide

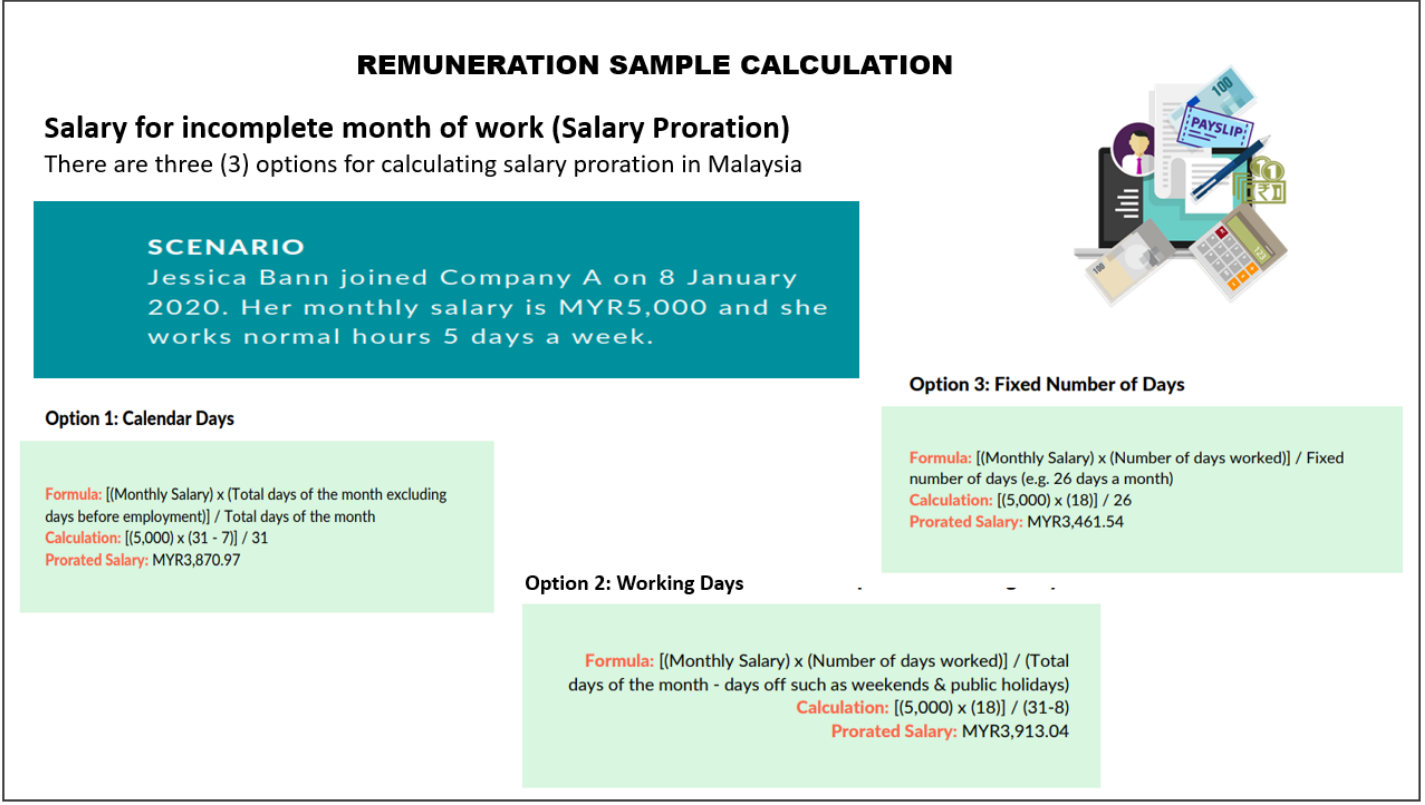

3 Ways To Do Bonus Calculation Pcb Without Payroll Software

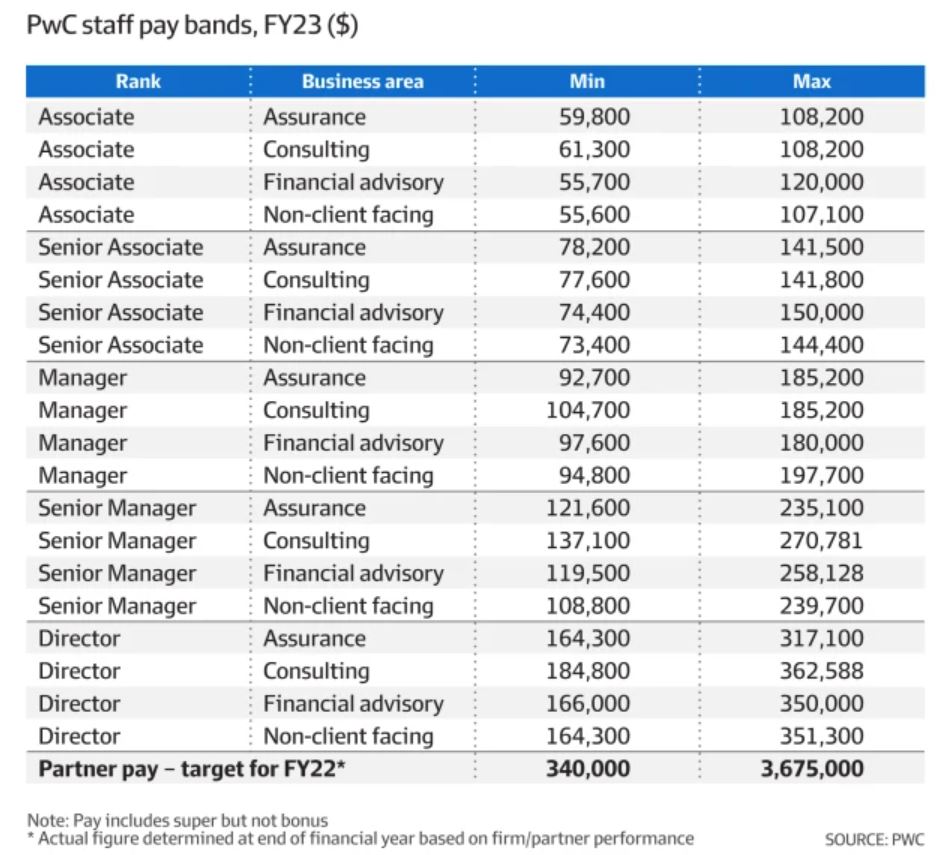

What Is The Average Big 4 Partner Salary How Much Do They Make

Ex Gratia Payment Meaning Examples What Is Ex Gratia

.jpg)

Importance Of Issuing A Payslip In Malaysia Insights Propay Partners

Forecasted Salary Increases In Malaysia Singapore Indonesia Thailand Vietnam In 2022

Malaysian Bonus Tax Calculations Mypf My

Bonuses And Incentives Human Resources Today

What You Need To Know About Employee Bonuses

Malaysian Bonus Tax Calculations Mypf My

Do You Need To Make Epf Payments For Bonuses And Cash Allowances In Malaysia Althr Blog

13th Month Pay An Employer S Guide To Monetary Benefits

Silver Bound Bonus Program Essential Oil Aromatherapy Young Living Essential Oils

Malaysian Bonus Tax Calculations Mypf My

Everything You Need To Know About Running Payroll In Malaysia